Aprobación del método de medición del riesgo SIIPDR en el manejo de asunción de riesgos

DOI:

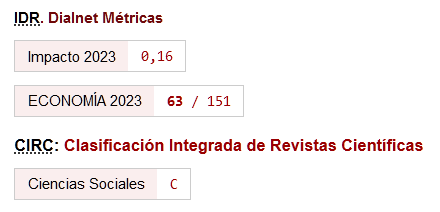

https://doi.org/10.46661/revmetodoscuanteconempresa.2193Palabras clave:

Uncertainty, risk, risk management, risk measurement, matrix, incertidumbre, riesgo, gestión de riesgos, medición del riesgo, matrizResumen

Este artículo está dedicado a la gestión del riesgo y a los métodos de medición de riesgos. El autor considera diferentes métodos de medición de riesgo y propone el método de la Suma Integral de Índices Ponderados Diferenciales de Riesgos (o método SIIPDR). Dicho método se basa en las matrices de riesgo empresarial dinámico. Dichas matrices describen los cambios de los valores de riesgo corporativos en el tiempo. El método ayuda a elegir la decisión de gestión del riesgo que tiene un buen efecto sobre los valores de riesgos corporativos. También se compara el método SIIPDR con otros métodos de medición del riesgo.

Descargas

Citas

Amram, M. and Kulatilaka, N. (1999). “Real options: Managing strategic investment in an uncertain world”, Boston: Harvard Business School Press.

Aven, T. (2007). “A unified framework for risk and vulnerability analysis covering both safety and security”, Reliability Engineering & System Safety 92, pp. 745–754

Bardossy, G. and Fodor, J. (2004). “Evaluation of Uncertainties and Risks in Geology”, Berlin: Springer.

Cabinet Office (2002). “Risk: Improving government's capability to handle risk and uncertainty”, Strategy Units, Cabinet Office, HM Government, London.

Cox, Jr. and Louis Anthony (Tony) (2008). “What’s Wrong with Risk Matrices?”, Risk Analysis: An International Journal, 28 (2), pp. 497–512.

Crowe, T.J.; Fong, P.M.; Bauman, T.A. and Zayas-Castro, J.L. (2002). “Quantitative risk level estimation of business process reengineering efforts”, Business Process Management Journal, 8 (5), pp. 490–512.

Damodaran, A. (2007). “Strategic Risk Taking: A Framework for Risk Management”, New Jersey: Pearson Prentice Hall.

Damodaran, A. (2012). “Investment Valuation: Tools and Techniques for Determining the Value of Any Asset”, New Jersey: John Wiley & Sons.

Dixit, A. and Pindyck, R. (1994). “Investment under uncertainty”, New Jersey: Princeton University Press.

Frey, R. and McNeil, A.J. (2002). “VAR and expected shortfall in portfolios of dependent credit risks: Conceptual and practical insights”, Journal of Banking and Finance, 26, pp.1317– 1334.

Glen, A. (2005). “Corporate financial management” (3rd ed.), Harlow: Pearson Prentice Hall.

Godet, M. and Roubelat, F. (1996). “Creating the future: the use and misuse of scenarios”, Long Range Planning, 29(2), pp.164–171.

Graham, J.D. and Weiner, J.B. (eds.) (1995). “Risk versus risk: Tradeoffs in protecting health and the environment”, Cambridge: Harvard University Press.

Hull, J.C. (2005). “Options, Futures, and Other Derivatives” (6th edition), New Jersey: Prentice Hall.

Kelley, K. (2007). “Sample size planning for the coefficient of variation from the accuracy in parameter estimation approach”, Behavior Research Methods, 39(4), pp. 755– 766.

Knight, F.H. (1921). “Risk, uncertainty and profit”, New York: Harper & Row.

Levine, E.S. (2012). “Improving risk matrices: the advantages of logarithmically scaled axes”, Journal of Risk Research, 15 (2), pp. 209–222.

Lintner, J. (1965). “The valuation of risky assets and the selection of risky investments in stock portfolio and capital budgets”, Review of Economics and Statistics, 47, pp. 13–37

Lipton, J., Shaw, W.D., Holmes, J., and Patterson, A. (1995). “Short communication: selecting input distributions for use in Monte Carlo simulations”, Regulatory Toxicology and Pharmacology, 21, pp. 192–198.

Markowitz, H. (1959). “Portfolio Selection: Efficient Diversification of Investments”, New York: John Wiley & Sons.

Meacham, B.J. (2010). “Risk-informed performance-based approach to building regulation”, Journal of Risk Research, 13(7), pp. 877–893.

Metropolis, N. and Ulam, S. (1949). “The Monte Carlo Method”, Journal of the American Statistical Association, 44, pp. 335–341.

Miller, E.G. and Karson, M.J. (1977). “Testing the equality of two coefficients of variation”, American Statistical Association: Proceedings of the Business and Economics Section, Part 1, pp. 278–283.

Miller, L.T. and Park, C.S. (2002). “Decision making under uncertainty –Real options to the rescue?”, The Engineering Economist, 47(2), pp. 105–150.

Modigliani, F. and Miller, M. (1958). “The cost of capital, corporation finance and the theory of investment”, American Economic Review, 48(3), pp. 261–297.

Modigliani, F. and Miller, M. (1963). “Corporate income taxes and the cost of capital: A correction”, American Economic Review, 53, pp. 433–443.

Porter, M. (1985). “Competitive Advantage”, New York: Free Press.

Pratt P. and Grabowsky J. (2011). “Cost of Capital: Workbook and Technical Supplement”, New Jersey: John Wiley and Sons.

Rao, P.M. (2010). “Financial Statement Analysis and Reporting”, New Delhi: PHI Learning.

Ratcliffe, J. (1999). “Scenario building: a suitable method for strategic property planning”, The Cutting Edge 1999, The Property Research Conference of the RICS St. John’s Collage, Cambridge, 5th-7th September.

Raubitschek, R.S. (1988). “Multiple Scenario Analysis and Business Planning”, Advances in Strategic Management, 5, pp. 181–205.

Rosa, E.A. (1998). “Metatheoretical foundations for post-normal risk”, Journal of Risk Research, 1, pp. 15–44.

Rosa, E.A. (2003). “The logical structure of the social amplification of risk framework (SARF): Metatheoretical foundation and policy implications”, in: N. Pidegeon, R.E. Kaspersen, and P. Slovic (eds.). The social amplification of risk (pp. 47–76). Cambridge: Cambridge University Press.

Scholleová, H. (2008). “Basic Areas of Utilization of Real Options to Manage a Firm”, Acta Oeconomica Pragensia, 16 (4), pp. 3–11.

Scott, J.H. (1976). “A theory of optimal capital structure”, Bell Journal of Economics, 7, pp. 33–54.

Sharpe, W.F. (1964). “Capital asset prices: A theory of market equilibrium under conditions of risk”, Journal of Finance, 19, pp. 425–442.

Teach, E. “Will real options take root? Why companies have been slow to adopt the valuation technique”, CFO Magazine, 1 July 2003. Web: 10th Feb., 2014.

Trigeorgis, L. (1996). “Real Options: Managerial Flexibility and Strategy in Resource Allocation”, Massachusetts: MIT Press.

Descargas

Publicado

Cómo citar

Número

Sección

Licencia

Derechos de autor 2014 Revista de Métodos Cuantitativos para la Economía y la Empresa

Esta obra está bajo una licencia internacional Creative Commons Atribución-CompartirIgual 4.0.

El envío de un manuscrito a la Revista supone que el trabajo no ha sido publicado anteriormente (excepto en la forma de un abstract o como parte de una tesis), que no está bajo consideración para su publicación en ninguna otra revista o editorial y que, en caso de aceptación, los autores están conforme con la transferencia automática del copyright a la Revista para su publicación y difusión. Los autores retendrán los derechos de autor para usar y compartir su artículo con un uso personal, institucional o con fines docentes; igualmente retiene los derechos de patente, de marca registrada (en caso de que sean aplicables) o derechos morales de autor (incluyendo los datos de investigación).

Los artículos publicados en la Revista están sujetos a la licencia Creative Commons CC-BY-SA de tipo Reconocimiento-CompartirIgual. Se permite el uso comercial de la obra, reconociendo su autoría, y de las posibles obras derivadas, la distribución de las cuales se debe hacer con una licencia igual a la que regula la obra original.

Hasta el volumen 21 se ha estado empleando la versión de licencia CC-BY-SA 3.0 ES y se ha comenzado a usar la versión CC-BY-SA 4.0 desde el volumen 22.